Getting The Affordable Bankruptcy Lawyer Tulsa To Work

Getting The Affordable Bankruptcy Lawyer Tulsa To Work

Blog Article

Some Known Details About Best Bankruptcy Attorney Tulsa

Table of ContentsSome Known Details About Experienced Bankruptcy Lawyer Tulsa The Best Strategy To Use For Tulsa Bankruptcy Legal ServicesBankruptcy Attorney Near Me Tulsa Fundamentals ExplainedNot known Facts About Chapter 7 Vs Chapter 13 BankruptcyThe Only Guide for Top-rated Bankruptcy Attorney Tulsa Ok

The stats for the other primary type, Chapter 13, are even worse for pro se filers. Suffice it to state, talk with a lawyer or two near you who's experienced with insolvency regulation.Several lawyers likewise supply totally free examinations or email Q&A s. Benefit from that. (The non-profit application Upsolve can assist you find complimentary appointments, sources and lawful help for free.) Ask them if insolvency is undoubtedly the right choice for your scenario and whether they assume you'll qualify. Before you pay to file personal bankruptcy forms and blemish your credit record for approximately ten years, examine to see if you have any type of sensible choices like financial obligation settlement or charitable credit rating therapy.

Ads by Money. We might be made up if you click this ad. Ad Currently that you have actually decided bankruptcy is certainly the ideal program of activity and you with any luck cleared it with an attorney you'll need to obtain begun on the paperwork. Prior to you dive into all the main insolvency forms, you need to obtain your very own records in order.

Tulsa Bankruptcy Lawyer Things To Know Before You Buy

Later on down the line, you'll actually require to show that by revealing all kind of info regarding your monetary events. Below's a basic listing of what you'll require on the road in advance: Recognizing files like your vehicle driver's certificate and Social Protection card Income tax return (up to the past four years) Proof of earnings (pay stubs, W-2s, self-employed incomes, earnings from properties in addition to any kind of income from government benefits) Bank declarations and/or pension declarations Evidence of worth of your properties, such as lorry and realty appraisal.

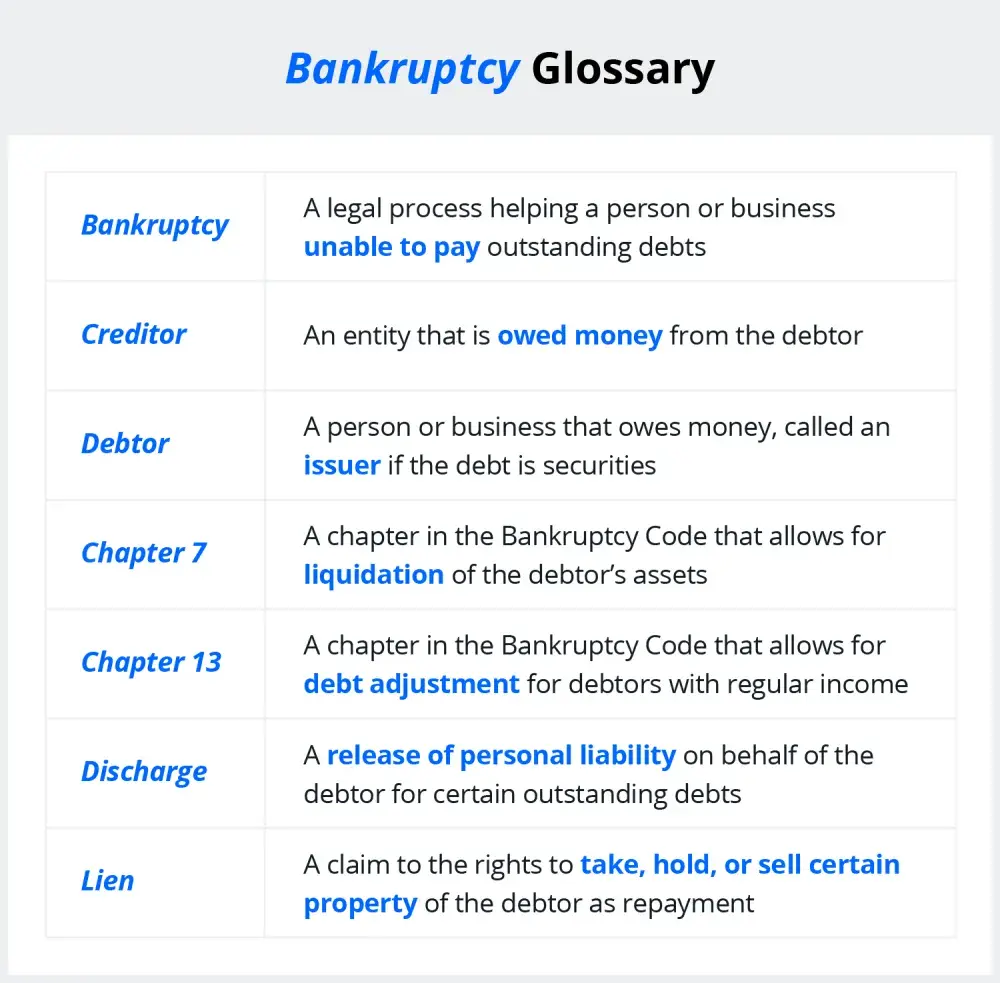

You'll wish to comprehend what sort of financial obligation you're attempting to deal with. Financial debts like youngster support, alimony and particular tax debts can not be discharged (and personal bankruptcy can't halt wage garnishment related to those debts). Trainee funding financial debt, on the various other hand, is not difficult to release, yet keep in mind that it is hard to do so (bankruptcy lawyer Tulsa).

You'll wish to comprehend what sort of financial obligation you're attempting to deal with. Financial debts like youngster support, alimony and particular tax debts can not be discharged (and personal bankruptcy can't halt wage garnishment related to those debts). Trainee funding financial debt, on the various other hand, is not difficult to release, yet keep in mind that it is hard to do so (bankruptcy lawyer Tulsa).If your income is too expensive, you have one more alternative: Phase 13. This option takes longer to fix your financial obligations since it needs a lasting settlement plan generally three to 5 years before some of your staying debts are wiped away. The filing process is also a lot more intricate than Phase 7.

Not known Incorrect Statements About Experienced Bankruptcy Lawyer Tulsa

A Chapter 7 bankruptcy remains on your credit record for 10 years, whereas a Phase 13 insolvency drops off after 7. Before you submit your personal bankruptcy kinds, you need to first finish a required training course from a credit rating counseling company that has been accepted by the Department of Justice (with the notable exemption of filers in Alabama or North Carolina).

The program can be finished online, in individual or over the phone. Training courses generally set you back in between $15 and $50. You have to complete the program within 180 days of declaring for insolvency (Tulsa OK bankruptcy attorney). Utilize the Department of Justice's website to locate a program. If you stay in Alabama or North Carolina, you need to choose and complete a program from a list of independently approved carriers in your state.

Not known Facts About Bankruptcy Law Firm Tulsa Ok

Examine that you're filing with the appropriate one based on where you live. If your long-term home has actually moved within 180 days of filling up, you must file in the district where you lived the higher part of that 180-day period.

Usually, your personal bankruptcy lawyer will certainly function with the trustee, however you might need to send the person records you could look here such as pay stubs, tax obligation returns, and financial institution account and credit history card declarations straight. A typical mistaken belief with insolvency is that once you file, you can stop paying your financial obligations. While insolvency can assist you clean out several of your unsafe financial obligations, such as past due clinical bills or personal fundings, you'll desire to keep paying your regular monthly settlements for secured debts if you want to keep the home.

Not known Facts About Chapter 7 Vs Chapter 13 Bankruptcy

If you go to threat of repossession and have tired all various other financial-relief alternatives, then applying for Phase 13 may postpone the foreclosure and conserve your home. Ultimately, you will certainly still need the earnings to proceed making future home loan settlements, in addition to settling any type of late settlements over the program of your layaway plan.

If so, you may be called for to supply added details. The audit could postpone any type of financial debt alleviation by numerous weeks. Of course, if the great site audit transforms up incorrect info, your situation could be dismissed. All that said, these are relatively rare circumstances. That you made it this much at the same time is a decent indicator a minimum of a few of your debts are qualified for discharge.

Report this page